As discussed in our previous article The Top 5 Tips Obtaining Corporate Banking Facilities, this article will look further into how businesses can improve their credit scores in banks.

A credit score is a benchmark for a bank to approve the credit facility and determine the interest rate for the loans. Over the years, banks and regulators have utilized Risk-Adjusted Return on Capital (RAROC) to evaluate the return per credit risk, which is closely correlated with the credit score. The result can be used to assess the level of risk involved in different transactions. RAROC sets different minimum acceptable returns for different banks with respect to their scales and target clients. All in all, the credit score is essential for a bank to determine loan approval and interest rate.

Credit Score Application

Banks will look up to the credit score to calculate the loan-pricing such as interest rate and arrangement fee. The loan-pricing must meet the minimum requirement of RAROC, so as to ensure a meaningful return on capital. Apart from the loan-pricing, the credit score is also important for the risk classification of the banks. After grading, companies with the same grade will be reviewed together during portfolio management or changes in business strategies. From the banks’ perspective, the credit score is a key indicator of the level of risk involved in transactions with corporates. A corporate with a higher credit score has a higher likelihood to obtain loan approval; A lower credit score means a corporate probably has a lower chance to obtain loan approval or needs further credit enhancement such as securities to support its credit facility application or has to pay a higher interest rate.

Credit Score Quantitative Factors

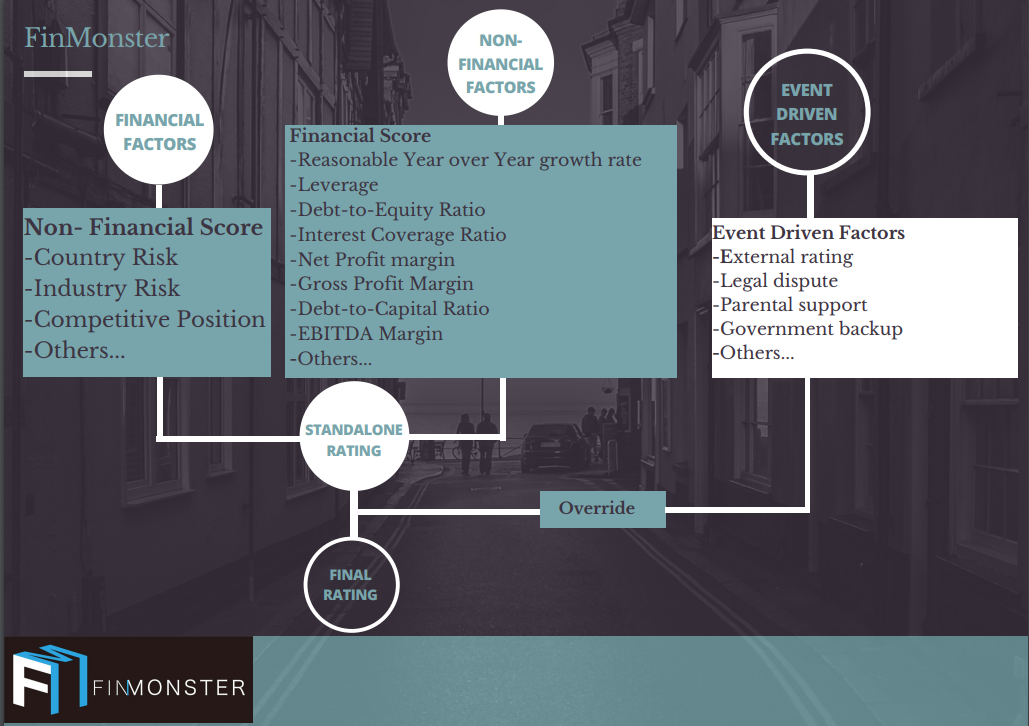

The credit score composes of a few parts, namely Quantitative and Qualitative plus the warning signal grade change rule. The quantitative components are figures derived from the financial statement of the company, which are input by the Credit Analyst or Relationship Manager of banks. System of the bank will analyze the company’s financial statement after submission. The process of credit scoring involves numerous financial numbers, including but not limited to Debt-to-Capital Ratio, Debt-to-Equity Ratio, Interest Coverage Ratio, Gross Profit Margin, Net Profit margin, EBITDA Margin, reasonable Year over Year growth rate and Leverage. The numbers will be synthesized to generate an index in terms of Leverage, Profitability, Stability, Solvency, etc. These indexes will be ultimately weighted to form a standardized rating on the quantitative factors.

Credit Score Qualitative Factors

Qualitative factors focuses on macro-level items, including but not limited to the Country Risk, Industry Risk, Competitive Position, etc. Some of these factors are objective with clear guidance by the bank’s regular review and consistent to every corporate. For example, country risk and industry risk are determined by the bank and applied to corporates that fall into the same categories. Corporates cannot manipulate these factors given they are a reflection of the business environment such as the economic situation, the legal system, financial system, and industry cyclicality. Although a company can’t control these factors, banks can decide on the weighting to be applied to fit their credit appetite.

Meanwhile, the qualitative component is sometimes subjective subject to the research conducted by the bank’s analysts. For example, the competitive advantages, operating efficiency, and business diversity of the borrower are scrutinized by the analyst of the bank to provide a weighting into the credit rating score system based on these factors. The result may involve data from third-party research or industry intelligence.

Event-Driven Factors

After synthesizing the Quantitative Factors and Qualitative Factors, a preliminary credit score is generated before final confirmation. Before confirming the credit score, the bank will go through a checklist that evaluates the event-driven factors. The checklist compares the final rating with the corporate’s external rating, legal dispute, parental support, government backup, etc. These factors are straight forward with yes or no answer. Manually downgrade sometimes happens if the preliminary credit score is higher than the Credit Score after Event-Driven Factors are considered.

Actions to enhance your Credit Score

From the above observation, we can see that some objective factors are uncontrollable such as country risk or industry risk. However, a borrower could enhance his business credit score by actively improving other objective factors Such as quantitative factors are derived from company’s financial statement to reflect its business operation. Banks give higher priority to grant loans to borrowers whose business are stable, growing and profitable.

Briefly speaking, moderate leverage, high-profit margin and high financial growth rate contribute to a higher credit score. For the qualitative factors, a business may enhance its competitiveness in the industry, improve its operating efficiency and increase its market reputation to gain a higher score in the qualitative factors. However, there is no quick way to improve a company’s credit score from banks. A long-term business development plan is of paramount importance for a company to obtain a better offering from banks.